Renters Insurance in and around Lewisville

Looking for renters insurance in Lewisville?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented property is home. Since that is where you make memories and rest, it can be beneficial to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your books, bed, children's toys, etc., choosing the right coverage can make sure your stuff has protection.

Looking for renters insurance in Lewisville?

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the townhome or property you're renting. So, if you want to protect your valuables - such as a cooking set, a smartphone or a dining room set - renters insurance is what you're looking for. State Farm agent Marc Matney has the knowledge needed to help you choose the right policy and protect your belongings.

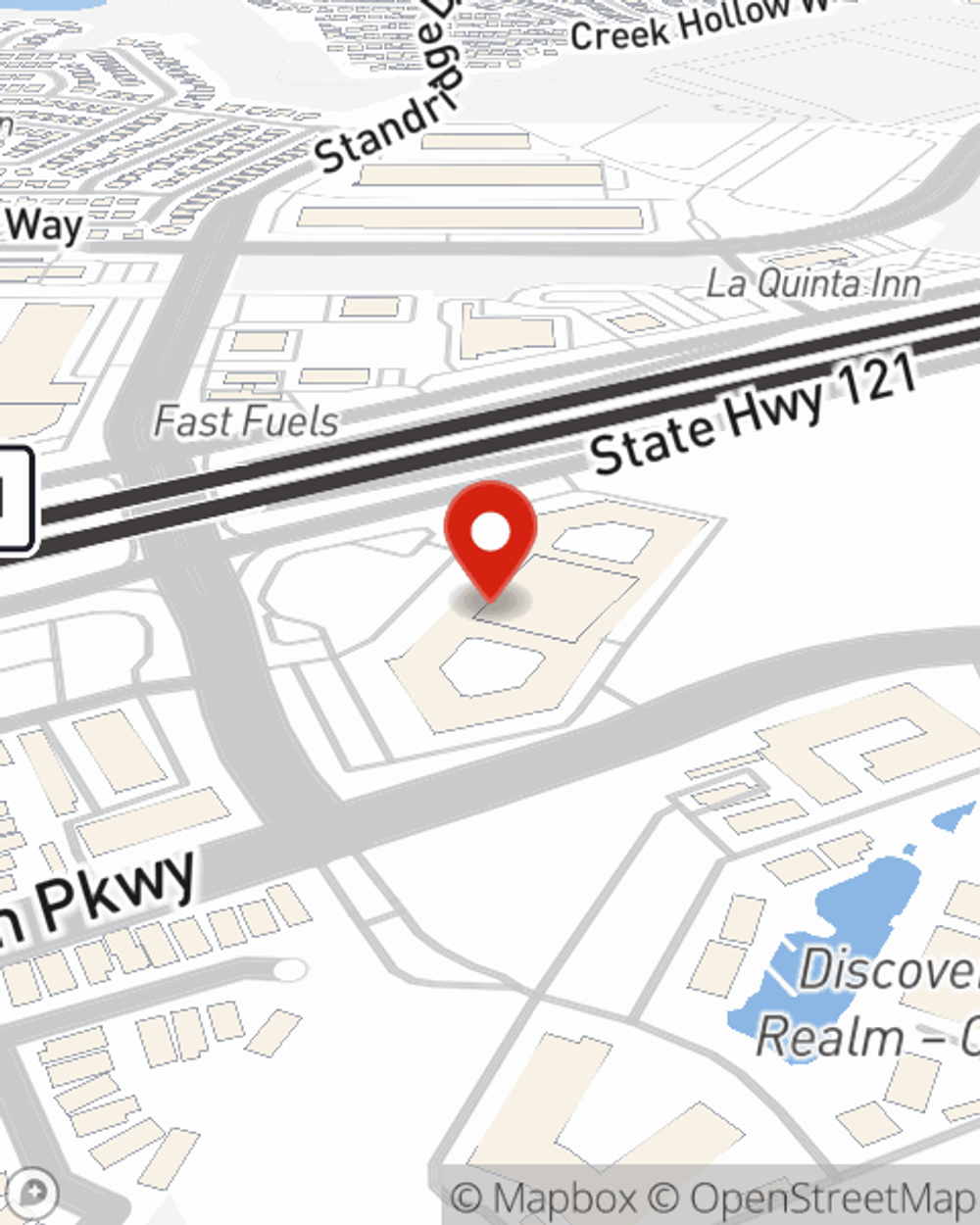

Renters of Lewisville, call or email Marc Matney's office to find out more about your specific options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Marc at (972) 292-3961 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Marc Matney

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.